The smart Trick of Credit Union Near Me That Nobody is Discussing

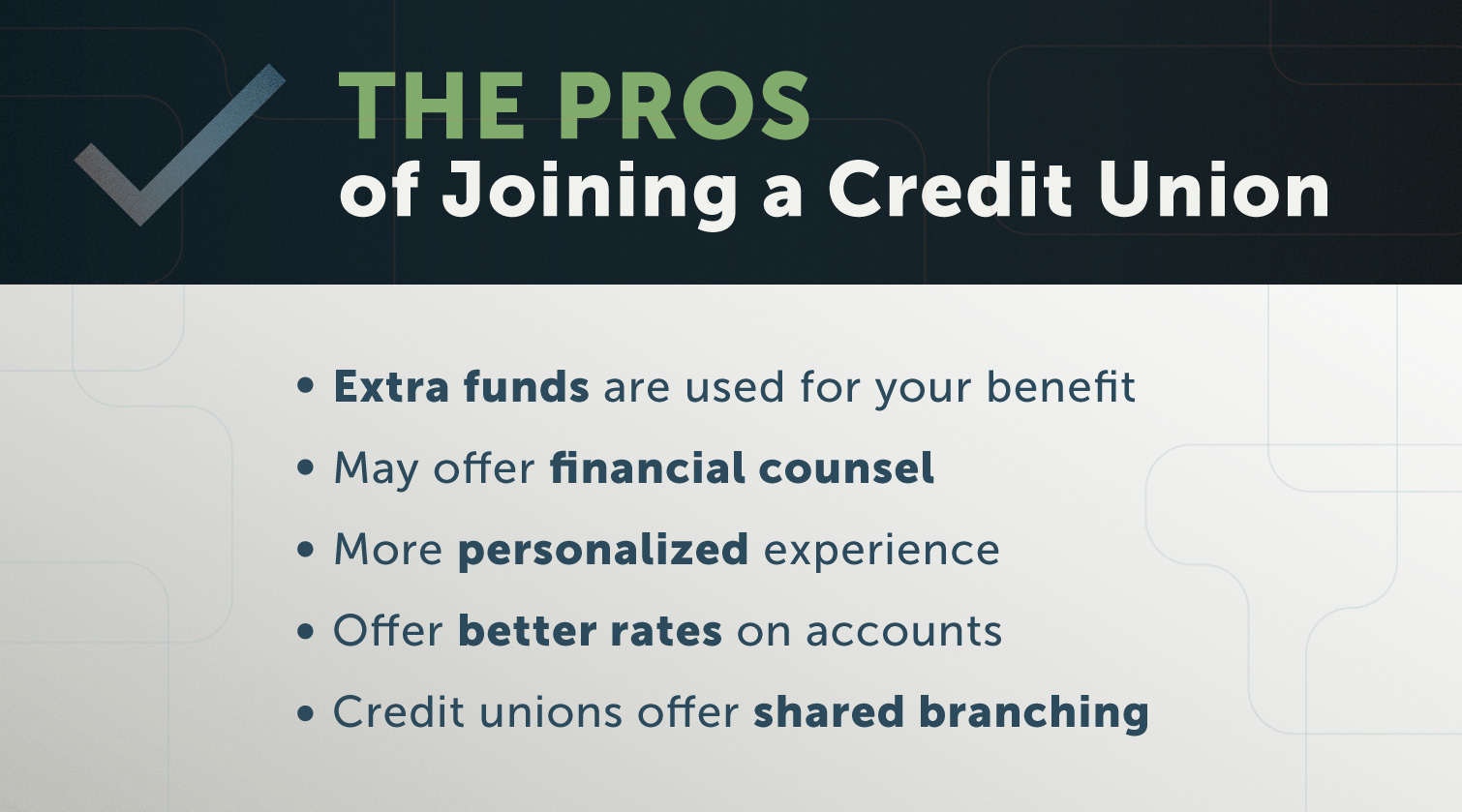

"We take a look at charge structure and locations to make certain [they] benefit the higher great," he says. In fact, when you sign up with a credit union, you become an owner, and that status equates into certain benefits: Credit unions provide a few of the very best rates on credit products such as vehicle loan, home loans and credit cards.

Credit Union Near Me for Beginners

That can be a big relief when your funds dip into the single digits. If you do not have a credit history or do however it's harmed, you might have severe difficulty scoring a charge card or loan with a low rate from a bank. Credit unions are more forgiving of people in this position.

Credit unions tend to use higher interest rates on savings and deposit accounts than banks do. Massachusetts-based Digital Credit Union, for circumstances, currently provides members a remarkable annual yield of 6.

Top Guidelines Of Credit Union Near Me

Many credit unions use them, but there may not be a variety of credit cards from which to select. Credit unions typically cater to a specific neighborhood or occupation.

How Credit Union Near Me can Save You Time, Stress, and Money.

To become a member of State Personnel' Cooperative Credit Union, you'll need to be a staff member of the state of North Carolina. Still, credit unions might deserve considering if you're dissatisfied with your bank or are looking for a more community-focused environment. If you think a cooperative credit union might be a great option for you, however you're unsure if you're eligible for any in your community, do not provide up.

"Individuals automatically think they can't sign up with because of the name or worry that it's some sort of club. If you do, opportunities are a friendly representative will welcome youand might draw you in as a new member of the household.

A Biased View of Credit Union Near Me

Today's consumers are looking for more than simply an organization to assist them handle their money. find out They want to discover a place that not only takes care of its members, supplying good rates and competitive services, but likewise contributes to the wellness of their neighborhoods, rather than that of their stockholders.

Credit Union Near Me Fundamentals Explained

So how does the non-profit and member-owned characteristics of a cooperative credit union particularly help its members? By focusing rather on members and passing on the advantages to them, credit unions can offer the following benefits. A cooperative credit union's focus on its members, not its revenues (and the accompanying nonprofit, tax-exempt status), means that instead of generating income off of clients, excess revenues and learn this here now savings are passed onto customers.

Fascination About Credit Union Near Me

Rather, one major benefit of nonprofits is that members can get better interest rates:. From mortgages to car loans, credit unions are frequently able to provide the least expensive interest rates on loans.

Lots of accounts are even complimentary. At Palisades, this consists of: Cooperative credit union can decrease the barriers to acquiring a house loan for their consumers. Even if go to this website your credit is less-than-perfect, a credit union might be able to assist you secure a house loan when banks turn you away. This is because credit unions are less focused on guaranteeing profit, and more thinking about promoting the monetary growth and health and wellbeing of their membersand purchasing a house is a great way to attain long-term financial stability.

Comments on “Get This Report on Credit Union Near Me”